Child Tax Credit 2024 Canada Phone Number

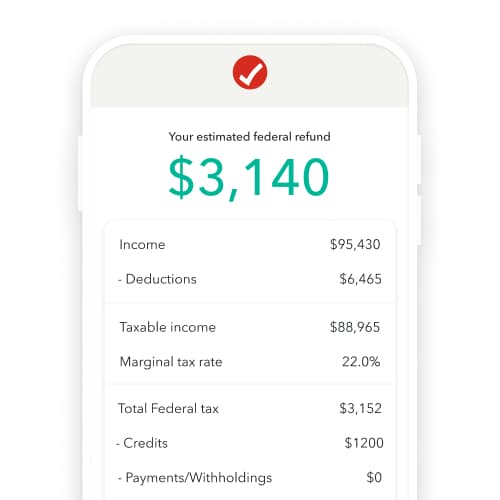

Child Tax Credit 2024 Canada Phone Number – Income: The Child Tax Credit for 2023 (from those applying in 2024) is worth $2000 provided that your adjusted gross income is below $200,000 as an individual or $400,000 as a combined parent. . To be eligible for the child tax credit, you must be a parent or guardian filing taxes in 2024. The child or dependent must have a Social Security number valid for employment in the U.S. and be under .

Child Tax Credit 2024 Canada Phone Number

Source : turbotax.intuit.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

How EV Tax Credits Work Car and Driver

Source : www.caranddriver.com

2023 and 2024 Child Tax Credit TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Child Tax Credit Boost in USA What Can be the Increase in Child

Source : matricbseb.com

How to fill out TD1 form if you have two jobs

Source : www.lucas.cpa

Child Tax Credit Boost in USA What Can be the Increase in Child

Source : matricbseb.com

25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.com

Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.com

Every EV Qualified for U.S. Tax Credits in 2024

Source : www.visualcapitalist.com

Child Tax Credit 2024 Canada Phone Number 2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax : For the 2024 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible taxpayers could receive an additional $100 . Altogether, fourteen states have established their own Child Tax Credit, with the majority having imposed limits on the total that can be claimed, according to the National Conference of States .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)