Tax Relief For American Families And Workers Act Of 2024 Information Systems

Tax Relief For American Families And Workers Act Of 2024 Information Systems – Employees may also One specific exemption that stands out is the “gift tax exclusion,” which permits giving money or assets to friends or family members without incurring taxes. . Commissions do not affect our editors’ opinions or evaluations. Tax relief companies say they can work with the IRS and state tax agencies to reduce or eliminate your tax debt. But the Federal .

Tax Relief For American Families And Workers Act Of 2024 Information Systems

Source : www.saxllp.com

Business Roundtable

Source : www.businessroundtable.org

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Pass the Tax Relief for American Families and Workers Act

Source : www.businessroundtable.org

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

US Tax Data Explorer | Taxes in the United States

Source : taxfoundation.org

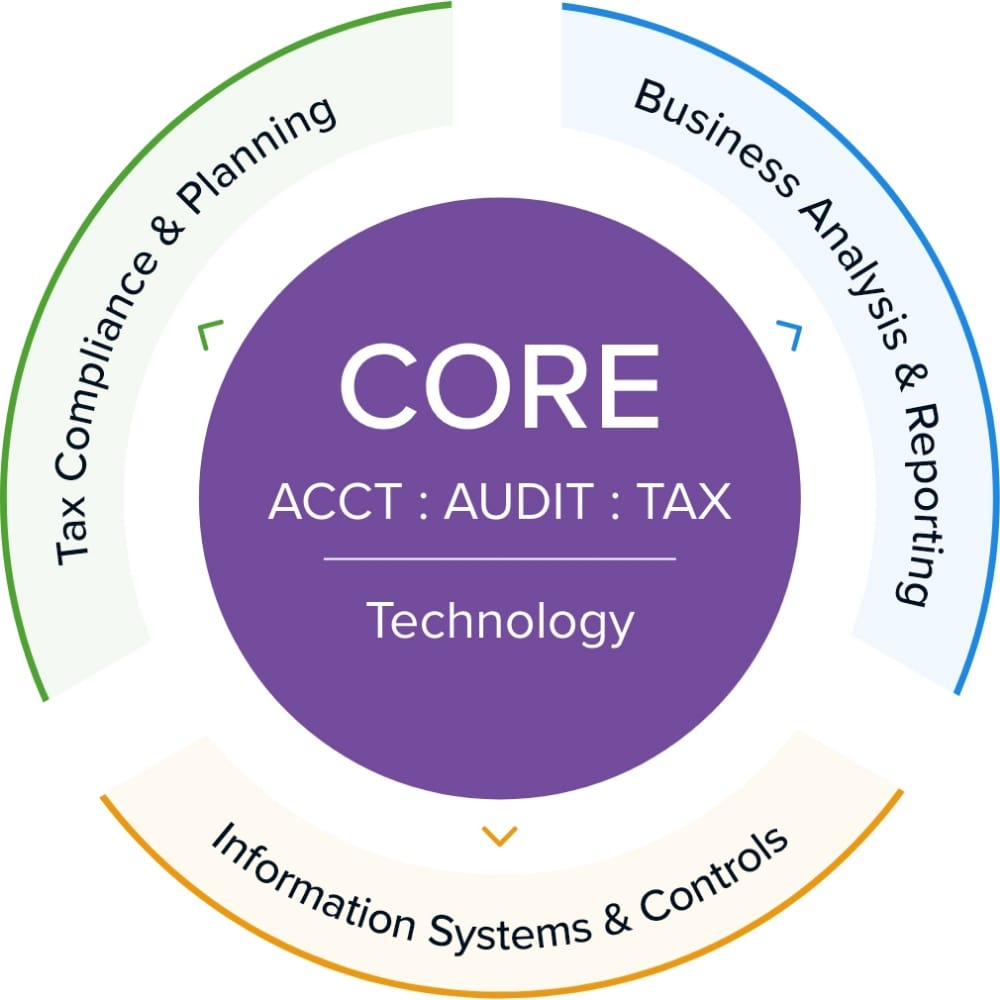

2024 CPA Exam Changes: CPA Evolution

Source : accounting.uworld.com

Center for American Progress | Washington D.C. DC

Source : www.facebook.com

DCWP Consumers Get Tips File Your Taxes

Source : www.nyc.gov

US Tax Data Explorer | Taxes in the United States

Source : taxfoundation.org

Tax Relief For American Families And Workers Act Of 2024 Information Systems Home SAX LLP Advisory, Audit and Accounting: Tax relief companies have a team of skilled your fee might increase is if there are changes in the scope of work due to new information not provided during the initial consultation. . Before making a decision, it’s crucial to gather all the necessary information to work with the IRS in resolving your debt. However, Optima Tax Relief has developed a two-phase system .

-6.jpg)